Most Important MCQs for Banking Entry-Level Candidates

1. What is the minimum paid-up capital requirement for Commercial...

Crime is a very psychic behavior, either by act or omission which deserves punishment. Banking crime is also a very sensitive issue in Nepalese Financial Sector, which affects public trust in banking and financial system. Public confidence is directly connecting with supply of money when demanded. Numbers of crimes related with banks and financial institutions is being increasing day by day in Nepal. The criminal can be the bank employees and outsiders (Hacking, Fraud, Thief, virus etc). Banking crimes are committed due to loopholes in the banking system, non-compliance, negligence, ineffective control system even though bank adopts tight security to protect banking system. Here are some examples which represents banking crime

a) ATM Fraud

ATM Fraud is a fraudulent activity where the criminal uses the card (ATM, Debit, Credit, Master) of another person to withdraw/ use money instantly from the card holder’s account. This type of fraud is simply done by using the PIN, clone card etc.

Tips: Don’t share your PIN, use your PIN (easy to remember but difficult to guess), while using ATM cover your keyboard with hand,

b) Cheque Fraud

Cheque Fraud is a very common form of financial crime in Nepal. There are three types

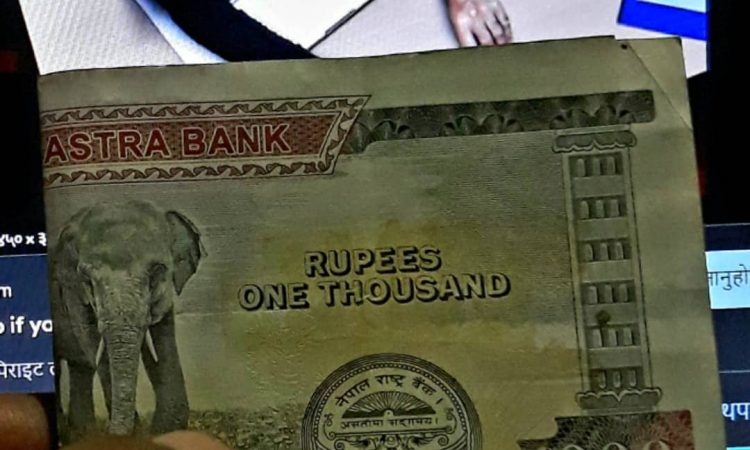

i) Counterfeit: Duplicate cheques are presented in trading or exchange purpose.

ii) Altered: Cheques are issued by drawer (account holder) and then changed /altered beneficiary or amount. Changing Rs. 150,000.00 instead of Rs. 50,000.00.

iii) Forgery: Stolen cheques are signed by someone other than the drawers.

Tips: Keep your cheque books safe, don’t left your signed cheque, proper checking of negotiable instrument while accepting, count your cheque book while acknowledging cheque book, write the amount from the left side, use permanent pen.

c) Cyber Crime

Cyber crimes are the illegal activities which are carried out by means of computers, internet. Cyber crime can be phishing, data hacking, internet banking hacking, sms banking hacking etc. normally hackers uses following method to hack your Internet/sms banking system

i) Creation of identical SMS/ Internet Banking App

ii) Trick to click their links which carries virus (once their links are installed on your computer or mobile, they can monitor your data (user, password etc)

iii) Lottery Scams: If somebody asks you to pay or deposit some amount in order to receive prize amount. For example: They will show as if they are from custom department and will ask to pay some amount for custom charge. They may use Viber, WhatsApp and e-mail.

Tips: Use private connection (free unknown Wi-Fi are not recommended to use), use antivirus, don’t click unauthorize links, suspicious link, keep your software updated.

d) Money Laundering

Money Laundering is the illegal process of making large amount of criminal activities (Drug trafficking, terrorist funding, extortion). Income without valid income sources.

Tips: ask too many questions, ask sources of income with document proof, monitor small amount deposit with maximum transaction (Deposit 2.00 Lac daily)

Note: Keep in mind that crimes start from home so never trust own person blindly in financial transaction.

For Bankers: Never believe your own family members, relatives while opening account, deposit amount, loan documentation, KYC, never relieve personal information/account detail to his/her spouse or family members.

For Customers: Don’t share personal information, protect your passwords, check and tally your bank account statement, beware from scam calls, protect your PIN, change passwords periodically, do not share your PIN, keep in mind that your bank will never ask for your account number, PIN Number, name and address, password in an email or SMS.

By: munankarmip